California Auto Insurance Requirements and Programs

Car Insurance Requirements

California mandates liability insurance to cover accident-related damages. The minimum coverage levels are:

- $15,000 for injury/death to one person

- $30,000 for injury/death to multiple people

- $5,000 for property damage

Additional Coverage Types

Beyond required liability coverage, drivers can purchase:

- Comprehensive coverage — protection against non-accident damage like theft

- Collision coverage — accident-related vehicle damage

- Medical and funeral services coverage

- Uninsured/Underinsured motorist coverage — covers damages from uninsured drivers (14.43% of CA drivers in 2004)

- Rental car and towing coverage

Note: Financed vehicles require comprehensive and collision coverage.

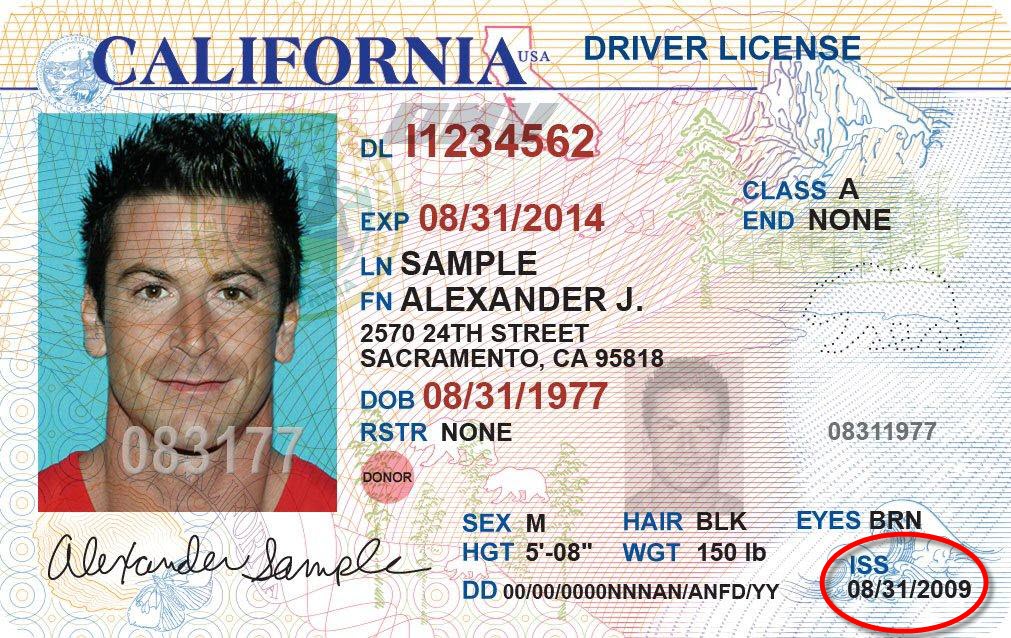

Proof of Insurance

Insurance cards must display vehicle information, policyholder names, and policy expiration dates. Electronic insurance cards via smartphone apps are permitted. California insurers report coverage electronically to the DMV.

Violations & Penalties

Driving without proof of insurance carries fines of $100–$200 for first offense, and $200–$500 for subsequent violations within three years. Vehicle impoundment is possible.

Registration Suspension

Registration may suspend if insurance lapses 45+ days, information isn't provided within 30 days of registration, or false evidence was provided. Reinstatement costs $14.

Proposition 103 (1988)

This voter-approved regulation required insurers to cut rates 20% below 1987 levels and established the Good Driver Discount — a mandatory 20% reduction for drivers with:

- 3+ years driving experience

- No more than one violation point

- No traffic school attendance (except once)

- No at-fault injury/death accidents

The law prohibits using credit history when calculating premiums.

Low Cost Auto Insurance Program (CLCA)

Established in 1999 for income-eligible drivers, requiring:

- Valid California driver's license

- Vehicle valued at $25,000 or less

- Age 19+

- Income qualification

Claims Mediation Program

Dispute resolution available for coverage extent, repair methods, damage causation, and total loss valuations—but not for coverage issues or policy interpretation.

Automobile Assigned Risk Plan (CAARP)

Provides liability insurance for drivers unable to obtain standard coverage due to poor driving records. Clean records for three consecutive years allow standard insurance purchase.

Additional Important Information

- Electronic cards: Smartphone apps provide digital proof of insurance

- Car theft: California had 156,796 vehicle thefts in 2011 (approximately $1 billion loss)

- Most stolen vehicles: Honda Accord, Civic, Chevrolet/Ford pickups, Toyota Camry, Acura Integra

- Accident reporting: Accidents exceeding $1,000 damage require Form SR 1 filing within 10 days

- Cell phone use: Illegal for drivers under 18 in all forms; drivers 18+ may use hands-free only